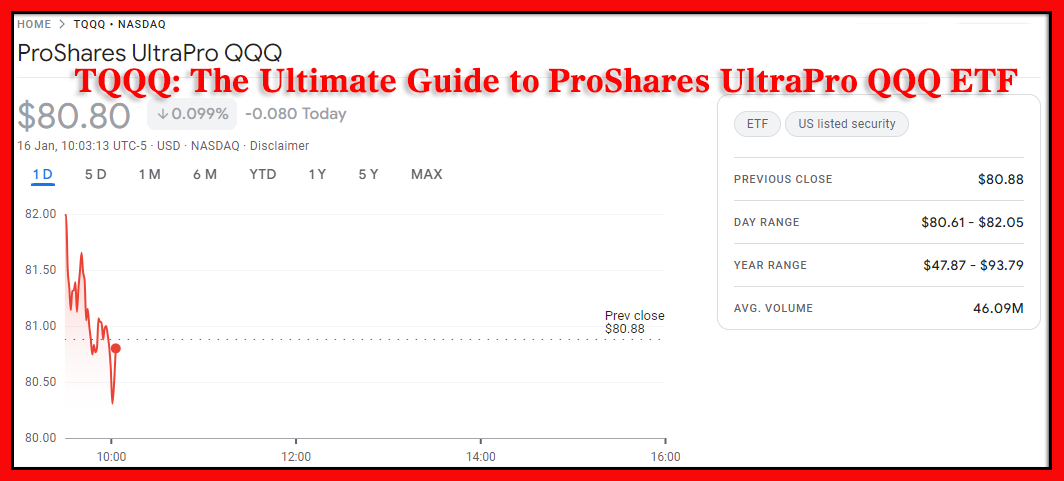

Presentation to TQQQ

TQQQ stands for ProShares UltraPro QQQ, a utilized exchange-traded support (ETF) outlined to give speculators with three times the day by day returns of the Nasdaq-100 File. The finance employments monetary subordinates, such as prospects contracts, to increment its presentation to the file. If the Nasdaq-100 Record rises by 1% on a given day, TQQQ’s planned to rise by 3%. Then again, if the list falls by 1%, TQQQ’s likely to drop by 3%.

Why is this vital in the world of ETFs?

TQQQ has gotten to be prevalent among dealers and financial specialists who need to take advantage of short-term cost developments in the stock advertise, particularly those who center on development stocks in segments such as innovation. Its utilized nature offers the potential for higher returns but comes with an similarly tall level of risk.

How does TQQQ’s work?

Leverage explained.

TQQQ is a utilized ETF, meaning it employments money related disobedient such as alternatives and prospects to intensify the returns of an basic list. Whereas standard ETFs such as QQQ reflect the execution of the Nasdaq-100, TQQQ’s looks for to triple that return on a day by day premise. It is critical to note that this use is connected every day, meaning that over the long term, returns can go astray altogether from the long-term execution of the Nasdaq-100 file by up to three times due to the impacts of compounding.

TQQQ Speculation Strategy

TQQQ fundamentally contributes in Nasdaq-100 stocks, which are non-financial companies recorded on the Nasdaq Stock Showcase. The basic list incorporates a assortment of tech-focused stocks such as Apple, Microsoft, Amazon, and Letter set. TQQQ’s employments a methodology of utilizing subordinates to accomplish its utilized objectives, which is why it is generally appropriate for short-term dealers who need to capture expansive developments in a single day.

TQQQ Composition

Nasdaq-100 File Overview

The Nasdaq-100 List is comprised of the 100 biggest non-financial companies on the Nasdaq Stock Trade. These companies are frequently pioneers in segments such as innovation, shopper administrations and healthcare. The record does not incorporate money related companies such as banks, making it an appealing choice for financial specialists looking to reflect an innovation-driven economy.

TQQQ’s Portfolio Components

According to the most recent information, TQQQ’s holds a more extensive assortment of stocks than the Nasdaq-100, with a much higher concentration in innovation. A few of the best property regularly include:

-

Apple Inc. (AAPL)

-

Microsoft Corp. (MSFT)

-

Amazon.com, Inc. (AMZN)

-

Tesla, Inc. (TSLA)

-

NVIDIA Organization (NVDA)

These companies contribute to the solid execution and instability that speculators encounter when contributing in TQQQ.

TQQQ’s Benefits

Leveraging for Superior Returns

One of the essential benefits of TQQQ is its capacity to increment benefits through use. This is particularly advantageous for dynamic dealers who accept that the Nasdaq-100 file will rise in the brief term. If the list performs well, TQQQ’s can create considerable benefits – frequently more than conventional ETFs that track the same index.

Access to Retail Investors

TQQQ gives retail financial specialists with an simple way to get to the Nasdaq-100 file with included use. Speculators do not require to buy person stocks or utilize edge accounts to pick up the same utilized presentation. This comfort has made TQQQ’s a prevalent choice for people looking for a higher-risk, higher-reward venture vehicle.

Benefits of Diversification

Although TQQQ centers on development stocks, it still gives speculators with introduction to divisions such as innovation, customer staples, healthcare, and more. This expansion can offer assistance decrease chance compared to contributing in person stocks.

Dangers Related with TQQQ’s

- Volatility and Use Risks

While TQQQ has the potential for tall returns, it moreover comes with critical dangers. The most eminent hazard is instability. The utilized nature of TQQQ’s implies that showcase instability can cause costs to alter quickly. In a profoundly unstable advertise, TQQQ’s can encounter extreme misfortunes, making it a less reasonable venture for preservationist investors.

- Long-Term Holding Considerations

TQQQ is not expecting for long-term speculation. Due to the compounding impact of every day use, long-term returns can altogether veer off from the anticipated execution of the Nasdaq-100 by up to three times. This makes TQQQ’s a superior fit for short-term dealers or speculators looking to take advantage of short-term advertise trends.

TQQQ Chronicled Performance

- Analyzing Past Returns

Historically, TQQQ has conveyed noteworthy returns amid periods of solid development in the Nasdaq-100 list. For case, amid periods of tech booms and financial extensions, TQQQ has been able to essentially beat its unleveraged partners. Be that as it may, amid periods of advertise redresses or tall instability, the support has shown leverage-related dangers, which have driven to other files such as SPY or QQQ underperforming.

- TQQQ’s Versatility Amid Showcase Downturns

During periods of advertise downturns or rectifications, TQQQ’s utilized nature implies it tends to drop speedier and harder than other ETFs. As such, it is vital for financial specialists to time their sections and exits carefully to minimize misfortunes amid bear markets.

Who ought to contribute in TQQQ?

Target gathering of people: Risk-tolerant investors

TQQQ is perfect for financial specialists with a tall hazard resilience who need to advantage from short-term developments. It is not appropriate for those with a moo chance craving or looking to develop their venture over the long term.

Suitable for short-term trading.

TQQQ is essentially planned for short-term dealers who need to benefit rapidly from day by day showcase developments. These dealers ordinarily utilize specialized investigation, chart designs, and advertise patterns to decide passage and exit points.

TQQQ vs. Other ETFs

- Comparison with QQQ and SPY

TQQQ is comparable to QQQ in that both ETFs track the Nasdaq-100 Record, but TQQQ offers three times the execution, whereas QQQ mirrors the execution of the list. SPY, on the other hand, tracks the S&P 500 Record, a wide record of the biggest U.S. companies. The key contrast is that TQQQ offers superior returns (and dangers) than both QQQ and SPY.

- Unique Highlights of TQQQ

Unlike QQQ or SPY, TQQQ’s day by day utilized methodology makes it a high-risk, high-reward venture vehicle. This interesting include can lead to noteworthy picks up, but it moreover uncovered speculators to higher losses.

How to Purchase TQQQ

Steps to Contributing in TQQQ

Investing in TQQQ is simple. You can purchase offers of TQQQ through most major brokerage accounts. The prepare includes:

-

Opening a brokerage account (in case you don’t as of now have one).

-

Funding the account.

-

Looking for the TQQQ ticker symbol.

-

Place a purchase arrange for the craved number of shares.

-

Choosing the Right Brokerage.

When choosing a brokerage, see for highlights like moo expenses, user-friendly stages, and inquire about instruments. Well known alternatives for buying TQQQ incorporate Constancy, TD Ameritrade, and Charles Schwab.

Conclusion: Is TQQQ Right for You?

TQQQ offers a capable apparatus for dealers looking to increment their benefits in the brief term. In any case, it is imperative to keep in mind that the utilized nature of this ETF presents noteworthy dangers, particularly for those looking to hold it for the long term. If you are a risk-tolerant financial specialist looking for prompt returns and are willing to effectively screen your ventures, TQQQ might be an fabulous expansion to your portfolio. Fair be mindful of the dangers and utilize fitting hazard administration strategies to ensure your capital. Eventually, whether TQQQ is right for you depends on your venture objectives, hazard resilience, and exchanging fashion. As continuously, counsel a budgetary advisor some time recently making any major speculation choices.

2 thoughts on “TQQQ: The Ultimate Guide to ProShares UltraPro QQQ ETF”